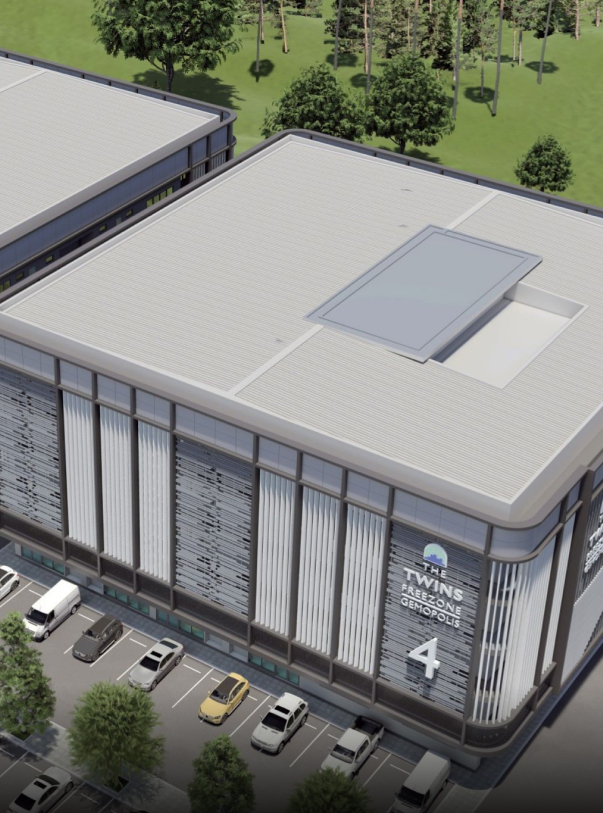

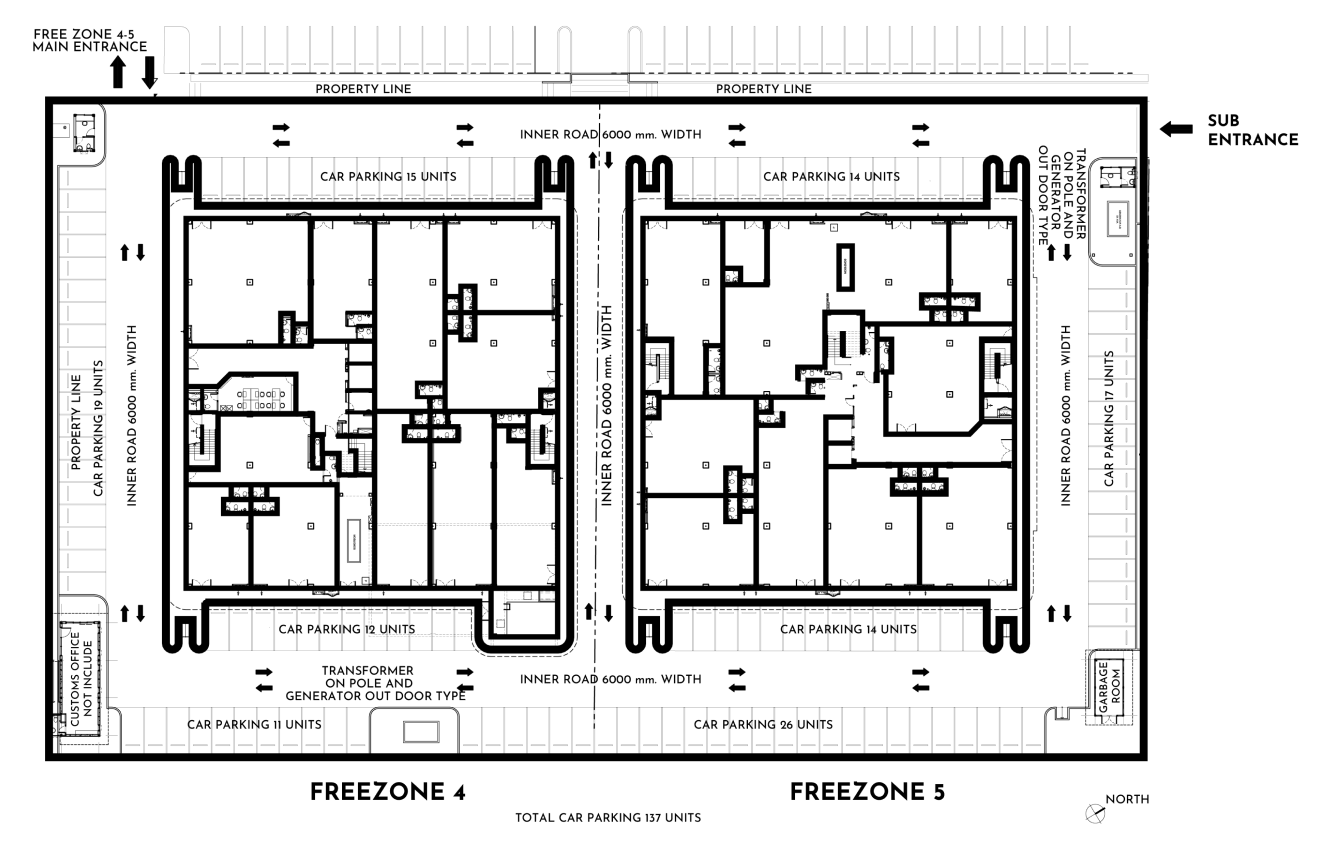

The Twins Freezone is the 4th and 5th phase of the Gemopol is Freezone comprising of 5-storey twin buildings with a net internal area of 15,000 sqm. The mixed-use project is designed under a vertical factory concept, fitting for the needs of small and medium businesses and industry. At Freezone, you could own a factory by occupying as little as 100 sqm.The smart unit concept enables flexibility in structural design leading to optimal utilisation for your business.

The Twins’ construction will commence in August 2022 and due for completion in August 2023. Factory owners could utilise many functions of the Gemopolis Freezone, whether as an office, showroom, maintenance service, manufacturing base, as well as warehouse for storage, processing, packing and distribution both for domestic and international.